A brisk week: big wearable debt, a Finland-to-EU CE mark, and fresh regulatory momentum for tinnitus therapy—plus Medtronic doubles down on a London robotics and AI hub.

People on the move

Medtronic Neurovascular: Dr. Adam S. Arthur named Chief Medical Officer, effective Sept 30; brings >20 years’ neurosurgery experience to stroke care strategy.

Olympus (Smart Connected Care): Appoints Slawek Kierner as Chief Digital Officer to accelerate connected-care strategy.

Money flows

Oura (FI): Secured $250M debt facility from a bank syndicate (JPMorgan, Goldman Sachs, BofA, Barclays, Citi, Wells Fargo) to fuel growth and operations. Signals continued appetite for consumer-grade, clinical-adjacent wearables in Europe. Since launching its smart ring in 2015, the company has now sold over 5.5 million units, with more than half of those sales occurring in just the past year.

In addition to record-breaking sales, ŌURA reported more than $500 million in revenue for 2024, representing a more than 200% increase from the previous year.

Ventech (FR/EU): Closes €175M Fund VI to back ~35 European startups across Seed–Series A; mandate spans digital health among other verticals. Good news for early-stage medtech/digital health founders in FR–DE–Nordics.

Axon Therapies (US) $32M Series A to advance heart failure therapy; co-led by Berlin-based Earlybird (EU investor read-through: continued EU GP exposure to cardio devices).

TransMedics × Mercedes-Benz (IT/EU): Strategic collaboration to launch Italy’s first dedicated organ-transport ground network (V-Class fleet) across four hubs to scale OCS perfusion logistics; part of broader EU rollout plans.

On the press

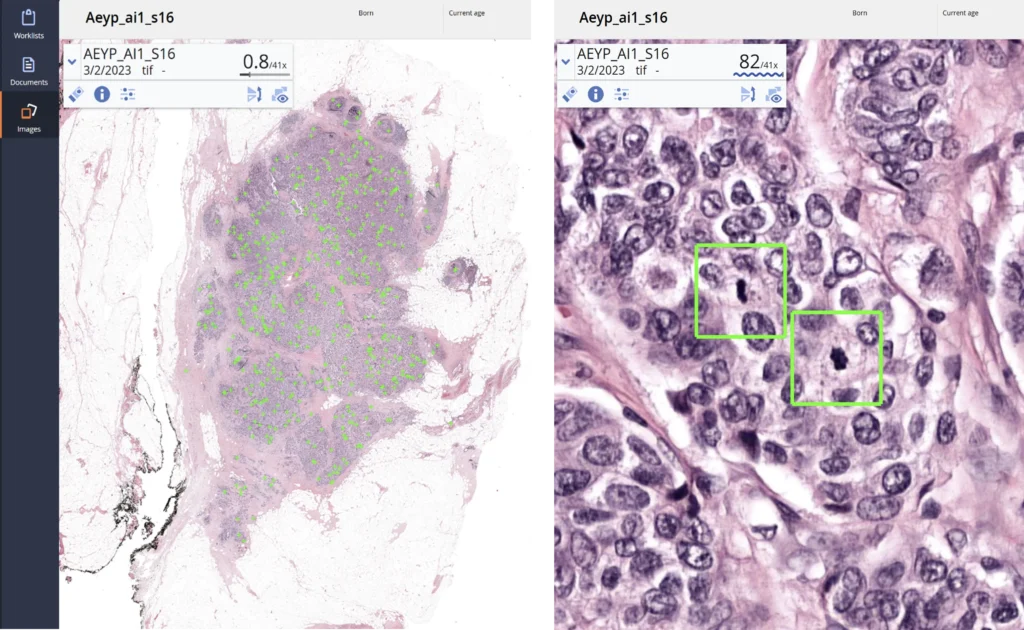

Marginum (FI): CE mark (MDR) cleared for HIVEN®, an intraoperative aspirate-tissue monitoring device to aid margin assessment in glioma surgery; Nordic clinical validation noted.

Neuromod Devices (IE): Achieves MDR certification and MDSAP; secures TGA (AU) and Health Canada approvals, ensuring ongoing EU availability and near-term international expansion for Lenire tinnitus therapy.

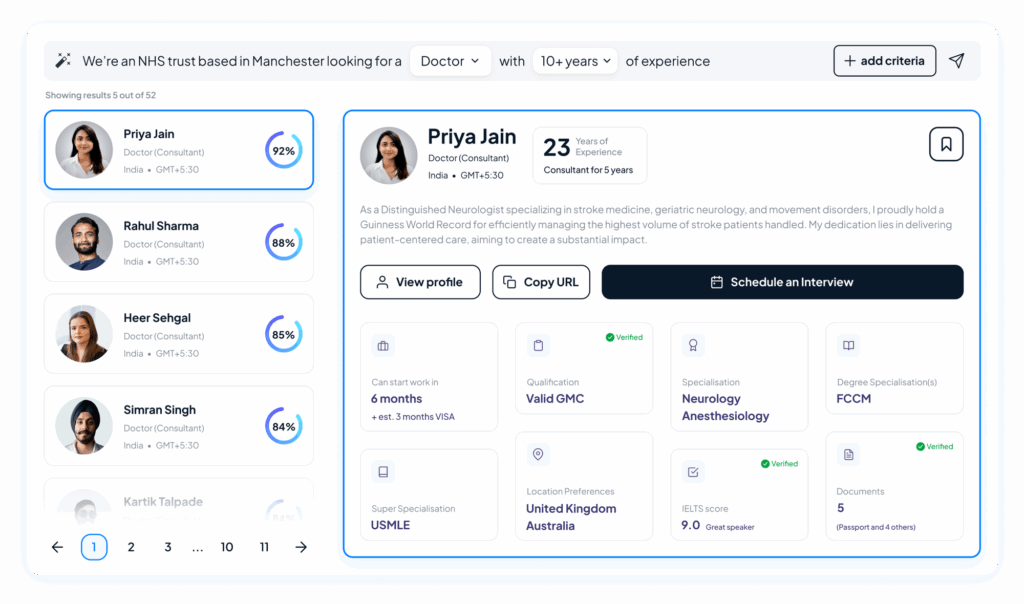

Medtronic (UK/EU): Doubles London presence to create a global hub for surgical robotics and AI, aligned with NHS 10-Year Health Plan collaboration ambitions.

Anova (UK/US) — Launches a global clinical registry (AnovaOS) for RWE and post-market surveillance—potentially useful for EU MDR PMCF and European study recruitment workflows.

One thing to remember

The week’s signal: European medtech commercialisation is accelerating on two tracks—scale capital (Oura debt, Ventech VI) and regulatory/market access (MDR clearances and global approvals), with major strategics (Medtronic) anchoring AI/robotics hubs in Europe. If you’re fundraising or launching in Q4, tie your story to measurable care delivery gains and MDR-ready evidence.