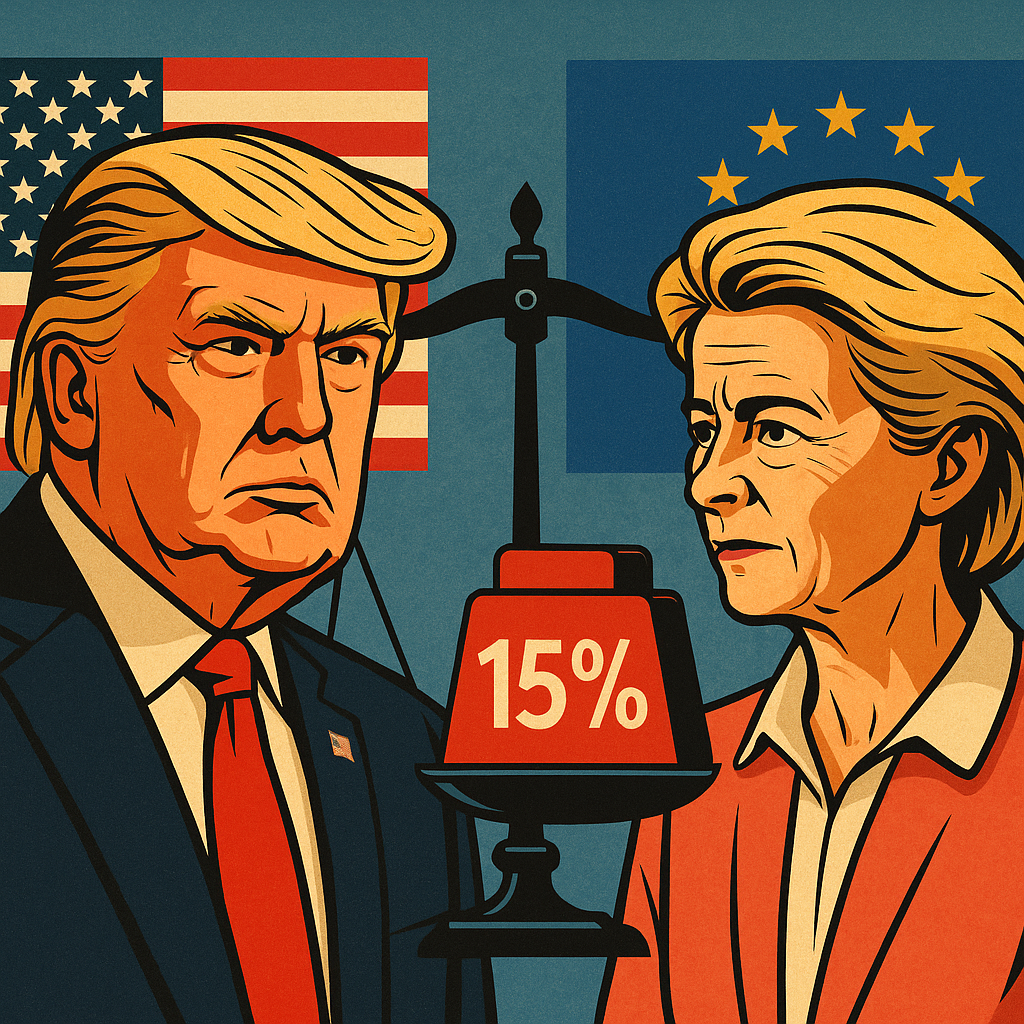

For most European medtech scale-ups, the US isn’t just another market — it’s the market. A successful launch across the Atlantic can double or triple a company’s valuation. But now, that expansion plan comes with a new 15% question mark.

On 5 August 2025, MedTech Europe warned that recent trade developments could see certain EU medical technology exports hit with tariffs of up to 15% under a US Executive Order issued in July 2025. The EU–US agreement avoided an all-out trade war, but the tariffs remain on the table — and the uncertainty alone is already reshaping business plans.

This tariff uncertainty comes on top of Europe’s AI Act–MDR/IVDR regulatory collision — another headwind flagged by MedTech Europe in recent weeks. For startups, the combined effect is a squeeze on both regulatory timelines and market profitability.

Why a 15% tariff is not ‘just a cost of doing business’

Unlike software, medtech hardware comes with a real bill of materials. A 15% tariff on top-line revenue is margin poison. Companies are forced into a lose–lose choice:

- Absorb the cost — eroding profitability and starving R&D, marketing, and expansion budgets.

- Pass it on to hospitals — instantly making products less competitive against US-based rivals or non-EU imports.

For growth-stage companies seeking FDA clearance and a US rollout, such volatility can make financial models unreliable. That makes investors nervous — and valuations softer.

From operational headache to valuation killer

In medtech fundraising, the US market often accounts for the largest chunk of projected future revenues in a discounted cash flow (DCF) model. Introduce a politically volatile tariff into that equation, and you’ve created a risk that’s impossible to ignore.

Two otherwise identical companies could now receive very different valuations purely based on the geography of their go-to-market plan. A US-heavy strategy becomes riskier than one targeting Asia, Latin America, or the Middle East first.

This is why geopolitical risk analysis — once the domain of multinational strategy teams — is becoming a necessary founder skillset.

My position: plan for volatility, not stability

We can hope for zero-for-zero tariff agreements that exempt medical technology from transatlantic trade friction. But hope is not a strategy.

Founders should treat the 15% tariff as a real scenario and build market entry plans accordingly. That means:

- Running financial models with and without the tariff.

- Exploring local manufacturing partnerships or assembly in the US to reduce exposure.

- Building contingency routes into Japan, South Korea, or Gulf states where demand for EU medtech is strong.

For VCs, due diligence should now include a tariff stress test — if the startup’s US plan collapses under 15%, you know the risk profile.

Founder and investor playbook

Founders:

- Develop a “Plan B” market entry route that doesn’t hinge solely on US sales.

- If US entry is core, investigate tariff mitigation options — including partial localisation.

- Be prepared to defend your US assumptions under investor scrutiny.

Investors:

- Apply a “geopolitical risk discount” to US-heavy strategies.

- Reward diversification in go-to-market plans.

- Work with portfolio companies on scenario planning for trade shocks.

Takeaway:

In 2025, geopolitical risk is no longer a footnote in medtech strategy. It’s a line item. Founders who can model it, plan for it, and still show a path to profitability will be the ones who keep investor confidence when trade winds shift.

Join the conversation

Are you already rethinking US market entry because of tariff risk? Have you successfully navigated similar trade barriers? Share your experiences and follow Disrupting Healthcare for practical, EU-focused strategies on building resilient medtech businesses.