If you work in HealthTech in Europe, you’ve probably noticed something strange. 2024 felt like the world was ending, yet the actual numbers say something very different.

Capital didn’t disappear — it simply stopped tolerating nonsense.

Now, in 2025, the money is flowing again, and aggressively so.

But it’s flowing selectively.

2024: The Great Reality Filter

Forget the headlines about a funding collapse. What actually happened in 2024 was a reset of expectations. Investors didn’t stop writing cheques, they just stopped writing them for half-baked pitch-deck poetry.

A study analysing ~1,300 funding rounds across European biotech, medtech and digital health showed fewer deals, but bigger ones.

Median pre-seed funding actually rose ~15.7% YoY to around €870K, which doesn’t sound like panic to me.

And Q3 2024 alone brought nearly US$2B in HealthTech investment..

The hubs were the usual suspects: UK, Germany, France, with Spain, Portugal and the Netherlands quietly moving up the table.

The hottest segments?

Oncology, biotech and AI-powered diagnostics: areas where outcomes are measurable and regulatory paths exist.

Karista summed up the year perfectly: a “reality filter”.

It was not a crash, but a sorting mechanism.

The pretenders left the room, the contenders stayed.

2025: Capital Is Back, Smarter

Then 2025 arrived and the mood changed fast.

According to Galen Growth, European digital health funding grew 52% YoY in H1 2025, totalling around US$3.4B across 182 deals. Europe is representing 26% of global funding

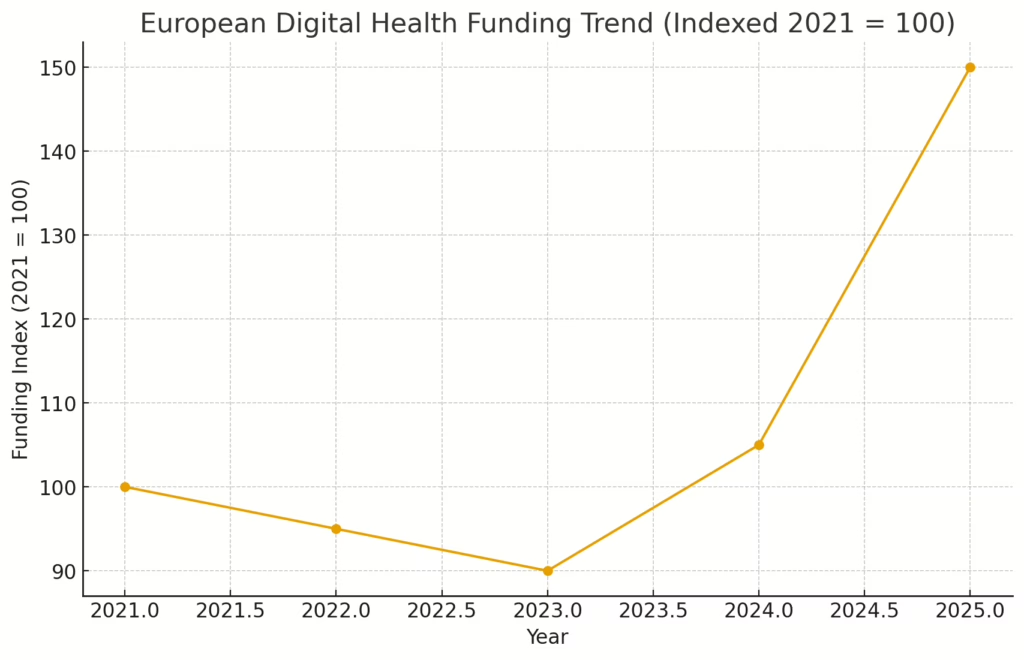

Figure 1. European Digital Health Funding Trend 2021–2025 (Indexed)

Indexed view using 2021 baseline of 100. 2025 funding growth (52% YoY, US$3.4B H1) based on Galen Growth. 2021–2024 values illustrative, derived from partial public snapshots. Source: disrupting.healthcare

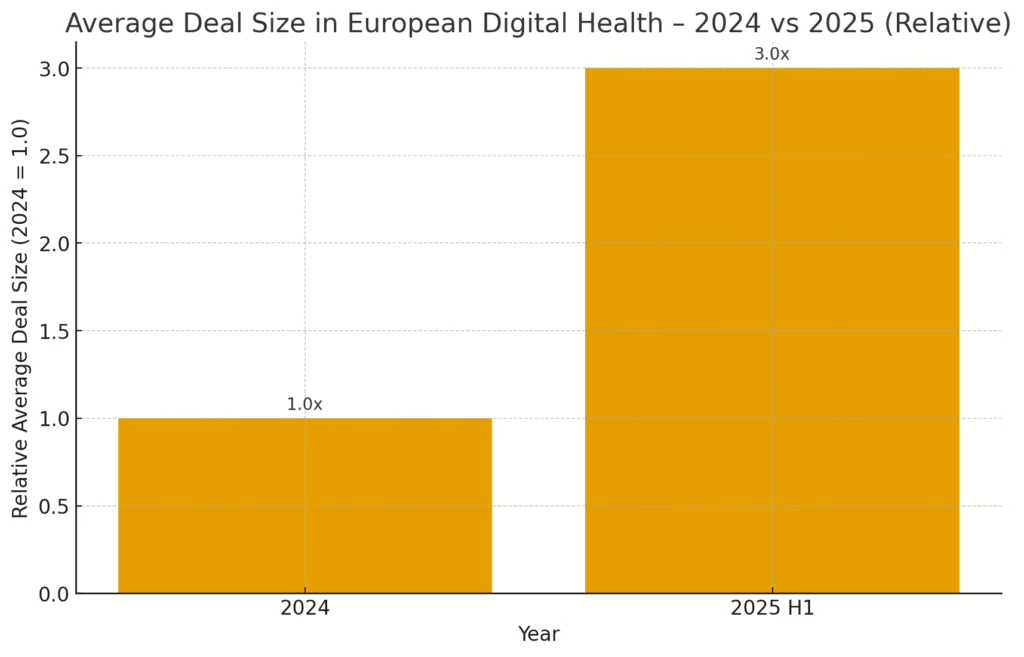

And the average deal size jumped to roughly US$18.6M, nearly three-times the Q2 2024 level.

Figure 2. Average Deal Size — 2024 vs 2025 (Relative)

Based on publicly reported 3× YoY increase in average deal size (Galen Growth, Healthcare.Digital). Source: disrupting.healthcare

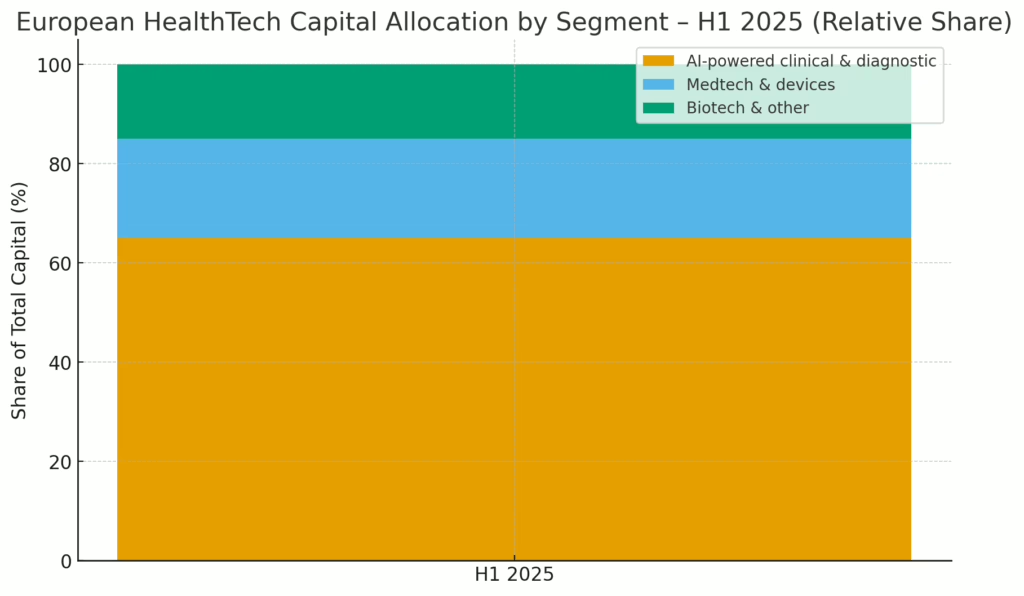

Even more striking: ~65% of all capital went to AI-powered clinical and diagnostic platforms.

Figure 3. Capital Allocation by Segment — H1 2025

~65% of capital allocated to AI-driven clinical & diagnostic platforms (Galen Growth, H1 2025). Source: disrupting.healthcare

The investment ecosystem has expanded dramatically:

254 active digital-health-focused funds in 2025 vs 84 in 2021.

This isn’t a hype revival, but it’s conviction capital. Investors aren’t betting on stories. They’re betting on proof.

The Difference in One Sentence

2024 sorted the real players from the noise.

2025 is paying the real players.

| Metric | 2024 | 2025 |

|---|---|---|

| Deal flow | Reduced volume | Clear acceleration |

| Average deal size | Reduced volume | €16M |

| Funding Focus | Biotech, oncology, med-device | AI-clinical & diagnostic |

| Investor tolerance | Traction required | Validation required |

| Entry barrier | Brutal | Still high, but capital available |

| Capital geography | UK, DE, FR | Broader pan-EU activity |

What to Do With This Information

If you’re a founder:

- If you have validation: raise now.

- If you only have a concept deck: don’t waste everyone’s time.

- Mix non-dilutive + VC — it’s no longer optional.

If you’re an investor:

- Europe is still undervalued vs the US — genuine upside exists.

- Secondary acquisitions are coming.

- AI is not a theme — it’s now an allocation mechanism.

It’s not 2021 again. 2025 is healthier, clearer, and honestly, more exciting.

Data Methodology & Transparency

The charts included in this article illustrate directional trends in European HealthTech funding rather than precise historical totals. Publicly available data does not provide continuous, fully aggregated funding records across all HealthTech sub-segments (digital health, medtech, diagnostics, biotech) from 2021 through 2024.

2025 funding values, including YoY growth, deal count and sector capital allocation are based on publicly reported figures from Galen Growth (H1 2025): European Digital Health Bucks the Global Trend

The indexed 2021–2025 funding trend chart is a normalized illustrative representation designed to highlight directional recovery and acceleration rather than exact historical volumes. Earlier periods (2021–2024) are estimated using partial public snapshots and normalized to a 2021 baseline of 100 to enable comparison.

The chart communicates trajectory, not absolute values.

Where precise historical figures are required (e.g. investor deck, financial report), a consolidated dataset should be constructed from Dealroom / PitchBook / CB Insights / Crunchbase Pro and national grant databases.

Next in This Series

Best Places to Launch or Scale a HealthTech Company in Europe

Spoiler: it is definitely not always London or Berlin.