Compliance tooling and workflow automation quietly had a massive week, capped off by the UK’s loud return to the CE mark conversation with a push for indefinite regulatory recognition.

People on the move

Dymicron

Peter Wehrly

The spinal motion-preservation technology company appointed the MedTech veteran to its Board of Directors to help navigate its US PMA pathway and drive international/European commercialization efforts.

The Mullings Group

Ann Gross

The global medtech executive search firm, which actively supports talent acquisition across Europe and the US, appointed Ann Gross as Vice President to bolster its advisory and talent access strategies.

Money flows

Flinn (Austria)

$20M, regulatory and quality automation (AI for PLM);

The Series A round was led by HV Capital, with participation from BHI – Bertelsmann Healthcare Investments, and continued support from existing investors Cherry Ventures, Speedinvest, and SquareOne. If MDR/IVDR paperwork is your bottleneck, investors are now explicitly paying to remove it.

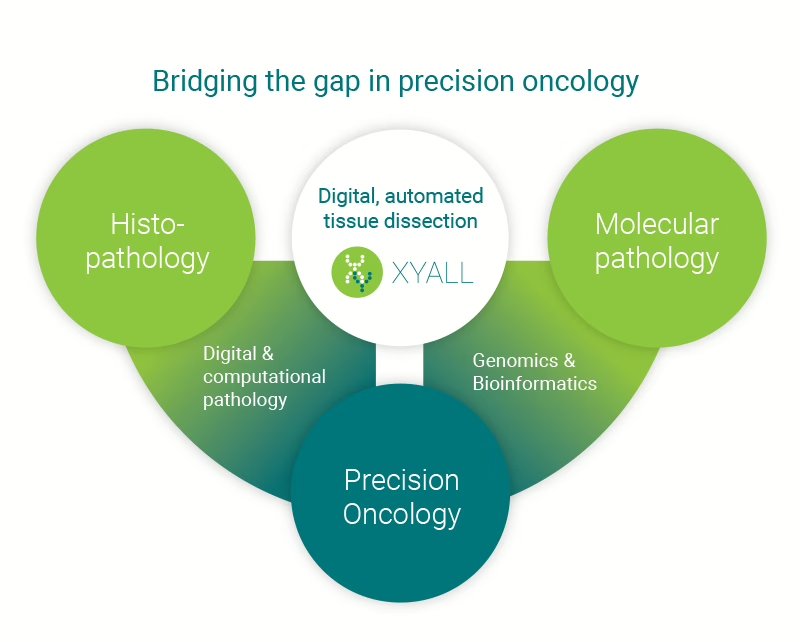

Xyall (Netherlands)

€7.6M, venture funding, automated tissue dissection for molecular pathology workflows; A consortium led by Capricorn Partners injected capital to scale the global rollout of Xyall’s systems, industrializing a notoriously tedious lab step.

Sendance (Austria)

€2.6M (total to date), convertible loan, wearable sensors; The startup secured fresh investment to grow its sensor grid and cloud platform that captures real-time data from mobility-focused devices like prosthetics and exoskeletons.

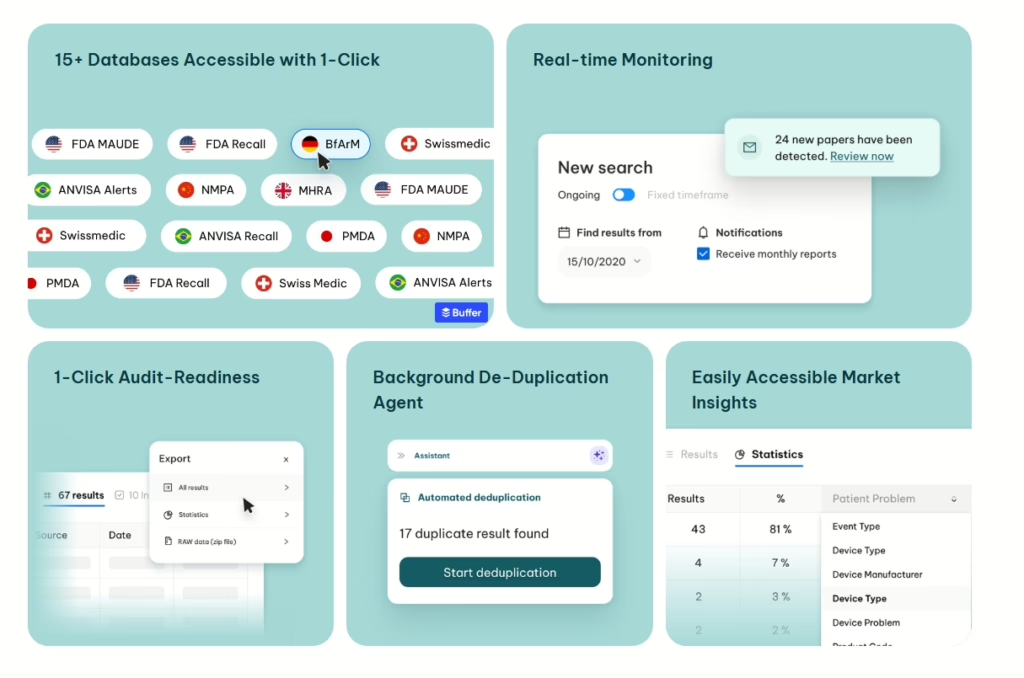

Klaris (UK)

$1M, pre-seed, regulatory compliance automation; Led by Meridian Health Ventures, the startup is addressing medtech technical documentation to push wider EU expansion, citing early traction in the UK and Italy.

On the press

UK MHRA (Great Britain)

The UK regulator launched a landmark consultation proposing the indefinite recognition of CE-marked (EU MDR/IVDR) medical devices in Great Britain. This signals a permanent shift away from the “UKCA-only” cliff edge, offering much-needed long-term certainty for European manufacturers.

One thing to remember

Europe’s next funding wave is drifting heavily toward workflow and compliance leverage. When paired with the UK MHRA’s push for indefinite CE mark recognition, investors are increasingly backing the “picks and shovels” that smooth out regulatory throughput and speed up commercial execution.