A brisk week: AI health coaching nets fresh capital, vet workflow AI gets a push, CE-marked remote monitoring scales, and Brussels opens the door for MDR/IVDR feedback.

People on the move

Dentsply Sirona: Aldo M. Denti appointed EVP & Chief Commercial Officer effective Oct 6 to align global business units with commercial execution. Mr. Denti brings extensive experience from J&J MedTech, especially DePuy (orthopaedics) and Acuvue (Vision Care).

Money flows

Simple Life (UK): €29.8M Series B, AI health coach; led by HartBeat Ventures. Plan: expand AI personalisation, gamification; claims strong revenue and active subs.

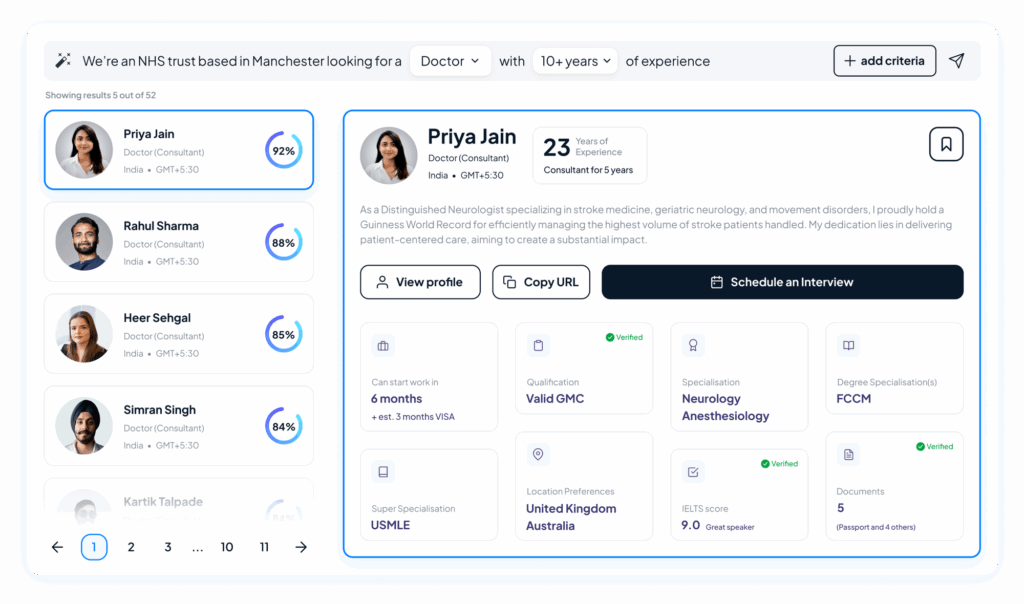

Lupa (UK): €17M Series A, AI-native operating system for veterinary clinics; launching a Veterinary AI Lab and scaling across Europe.

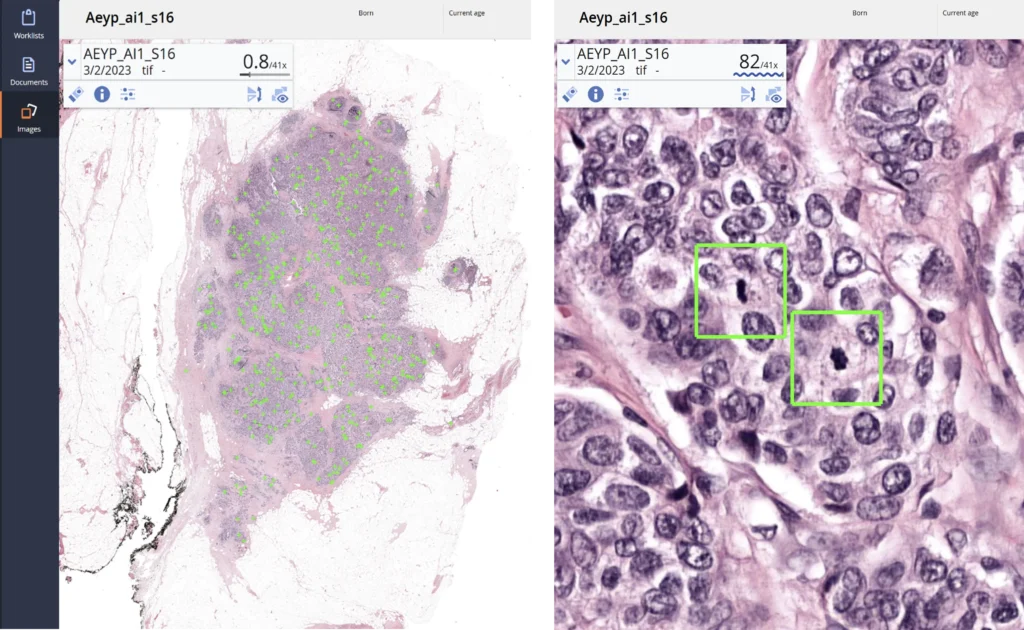

RDS (FR): €14M Series A to industrialise and expand MultiSense RDS, a CE-marked connected patch for continuous remote patient monitoring across Europe.

SeaBeLife (FR): €2M pre-Series A to advance dry AMD and severe acute hepatitis programs (biotech angle with medtech-adjacent implications for retina diagnostics ecosystems).

On the press

• European Commission launches a “Call for Evidence” on the future of MDR/IVDR (targeted revision to reduce burden, improve predictability, enable digitalisation). Deadline: Oct 6, 2025.

• HERA invites applications. Joint Industrial Cooperation Forum call is live; applications due by Oct 29, 2025 (17:00 CEST).

• Cardiology device rollout: Elixir Medical begins full European rollout of LithiX high-capacity IVL following CE mark; >400 patients treated across 16 countries.

• Swiss TAVI protection play advances in US. FDA clears pivotal trial for AorticLab’s FLOWer embolic protection system (already CE-marked in EU since 2024), signalling a scale-up trajectory for a Europe-born device.

One thing to remember

Regulation and reimbursement tailwinds matter: with Brussels actively revisiting MDR/IVDR and CE-marked RPM/IVL tools scaling across hospitals, founders who align early with compliance workflows and real clinical endpoints will move faster on procurement and pilots than those chasing generic “AI copilot” stories.