In 2020 Covid-19 pandemic focused humanity’s attention on healthcare and HealthTech. According to CB Report, 2020 was the year when a record number of seven digital health companies have achieved the status of unicorns.

The truth is not that exciting, as CB Report included two companies that are not digital health. Those are Gan & Lee (insulin manufacturer from China, recently wandering into oncology with a new CDK 4/6 inhibitor) and German CureVac, known for its breakthrough achievements in RNA vaccine technology.

While both are interesting for other reasons, we shall focus on the five digital health companies valued above one billion dollars. Who are those unicorns of 2020?

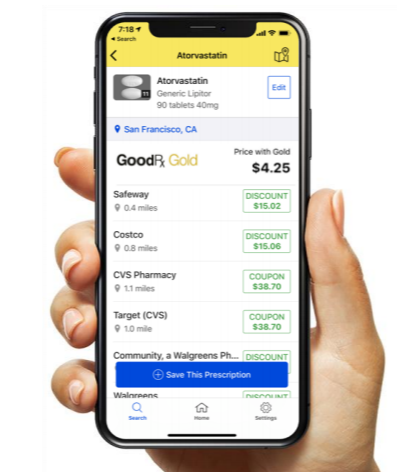

1. GoodRx; Valuation $12.7 billion

GoodRx, headquartered in Santa Monica, CA collects drug prices from pharmacies across the U.S. and helps users find the cheapest option for the medication they’re seeking. Its founders are Doug Hirsch (one of the first Yahoo! employees, later VP of Product at Facebook). Scott Marlette (who developed Facebook Photos) and Trevor Bezdek (founder of Tryrarc, an IT services and consultancy provider working with Anthem/BlueCross). It has been Doug’s personal experience of searching after the most affordable medicine, that has inspired GoodRx.

GoodRx had a very successful IPO and is profitable. However, it is facing competition from Amazon’s PrimeRx. When in November 2020 Amazon announced its offering, shares of GoodRx felt 23%. Another shock came in March 2021, when GoodRx presented its 2020 results with $551M revenue (42% growth YoY), but also an unexpected $230M net loss (in comparison to $63M net income in 2019).

I remain optimistic about GoodRx future, as it has maintained the growth of its user base and the service it is offering is helping US-based patients to save money while adhering to prescribed treatment.

See GoodRx investor presentation

2. Grail: $8 billion

Grail, based in Menlo Park, CA, is a company specialized in blood tests. Its main product, called the Galleri test, is able to detect more than 50 types of cancer from one blood sample. It allows for early detection of the disease, which highly improves chances for successful treatment. The idea behind the test is a combination of Machine Learning and insights gathered from the Human Genome Project. The commercialization of the Galleri test is expected this year.

Grail has started in 2016 as a spin-off from Illumina, supposed to focus on liquid biopsy. It has raised above $2bn from investors including Jeff Bezos and Bill Gates. Illumina has kept a stake in the company, and in September 2021 re-acquired Grail for $8bn.

3. One Medical: $1.7 billion

One Medical is a membership-based digital platform for primary care service. The focus is on a seamless patient experience. One Medical offers telemedicine, online appointments for same-day or next-day, on-site labs. One Medical work in 12 U.S. markets, is available in DTC model and as an employee health benefit.

Founded by Tom X. Lee (who founded also a mobile clinical reference app Epocrates), the company went public in January 2020, raising $245M with a valuation of $1.7bn. One Medical is not profitable yet, reporting a $14M loss for 2020, however, its revenues and user-base are rising.

See One Medical Q4 2020 report.

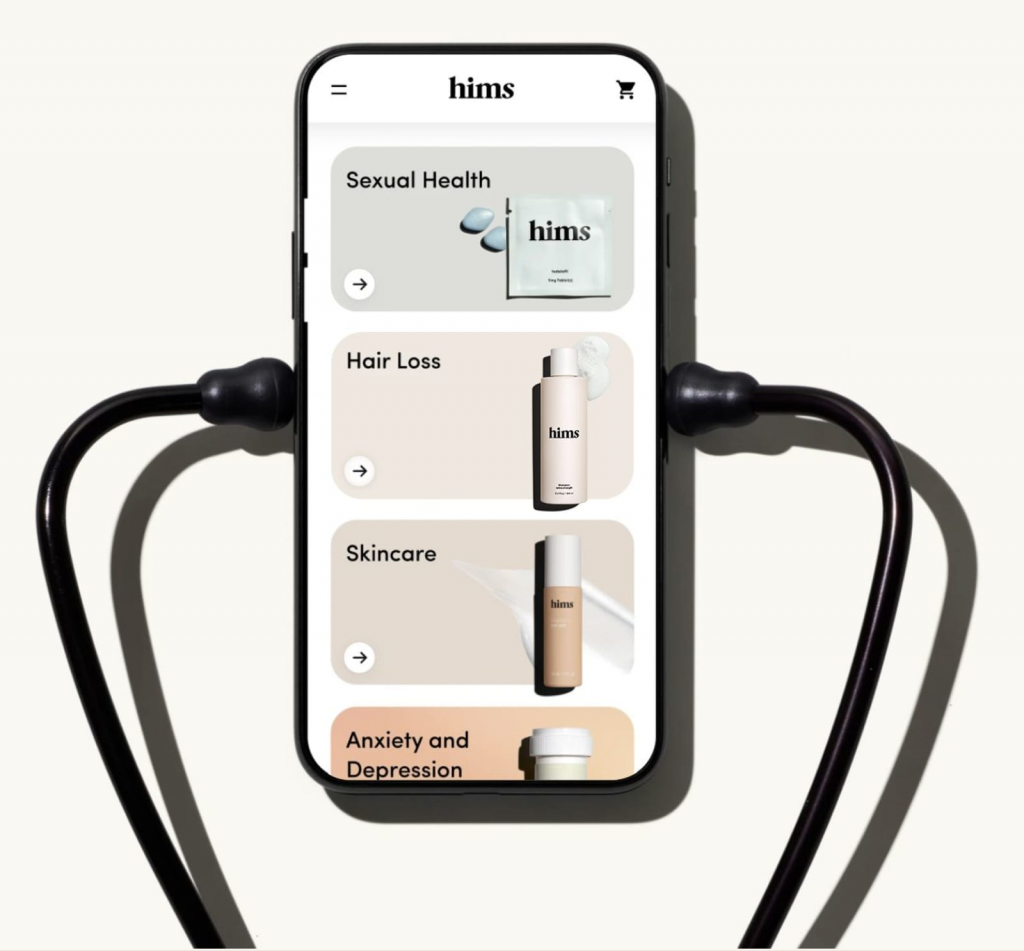

4. Hims & Hers $1.6 billion

Hims & Hers is a wellness brand operating digital pharmacy and telehealth platform. It has been started by Andrew Dudum and Jack Abraham via their VC Atomic. The initial offering o the company was around men’s health, in particular hair loss and erectile dysfunction, and it has been a tremendous success with $1M sales in the first week.

The company quickly grew with “hers” offering for women, and expansion into other therapeutic areas (primary care, mental health, dermatology). Hims & Hers includes its own EHR, and is targeting uninsured Millenials and Gen-Z patients with subscription plan priced at 20$ monthly.

The company went public in Jan 2021 raising $280M at the valuation of $1.6bn. While Hims & Hers is not profitable (estimated adj. EBITDA -$20M), its revenues are growing fast.

See Hims & Hers investor presentation.

5. Butterfly Network: $1.5 billion

Butterfly Network is working on a portable ultrasound medical imaging device. If successful it will decrease the cost and enable 3D imaging in remote areas, at home, or in an emergency setting with a Butterfly device and a smartphone.

The company is founded by Dr. Jonathan M. Rothberg, inventor of over 100 patents, mostly known for his work on next-gen DNA sequencing. As the company was heading towards IPO, it has also appointed a new CEO, Todd Fruchterman, former president of medical solutions at 3M.

Butterfly network went public via a merger with SPAC, at the valuation of $1.5bn. It has so far netted a $540M investment and it estimates to bring revenue of $78m in 2021.