Even with the right product, market, and team — many MedTech startups fail. And the reasons often come down to avoidable commercialization mistakes: misjudging the buyer, skipping regulatory nuance, or assuming your tech will sell itself.

This final post in the Scaling MedTech: From Product to Market series lays out the most common missteps in MedTech go-to-market and how to avoid them — with real-world examples and corrective actions.

1. Building Before Validating the Buyer

Mistake: Launching development without confirming who pays, who uses, and who benefits.

Too many founders build based on clinical need or innovation potential — without validating demand, budget holders, or economic value.

Fix: Use the JTBD (Jobs-To-Be-Done) framework + early payer interviews to design with reimbursement in mind.

2. Relying on Pilots Without a Conversion Plan

Mistake: Dozens of pilots, zero sales.

Pilots are easy to get — but unless there’s a conversion path, they drain resources and confuse investors.

Example: Many DTx startups in Germany listed under DiGA saw high downloads but failed to convert to revenue due to unclear therapeutic ownership.

Fix: Design pilots with: – Pre-negotiated success KPIs – Budget source for scale-up – Procurement-ready documentation

3. Ignoring Procurement and IT Requirements

Mistake: Gaining HCP interest, but failing at hospital onboarding.

Even if clinicians love your product, procurement, legal, and IT may reject it due to data compliance, MDR classification, or lack of integration.

Fix: – Include procurement in early demos – Prepare GDPR/Data Processing documentation – Get listed in hospital or GPO vendor systems (e.g., GHX)

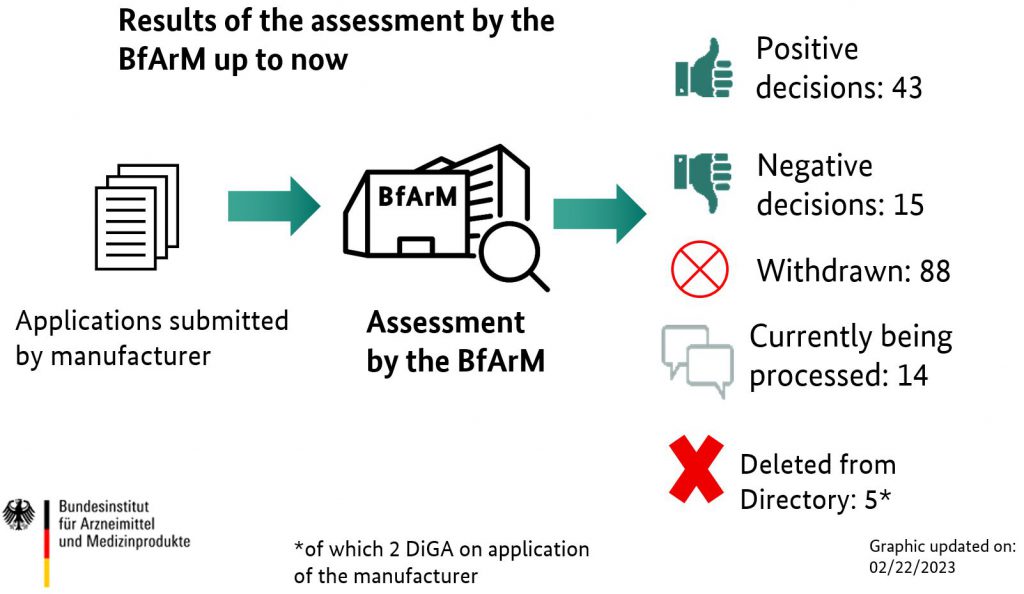

4. Misunderstanding Regulatory Signals

Mistake: Confusing CE marking or FDA approval with market readiness.

Regulatory clearance allows sales, but doesn’t guarantee adoption or reimbursement.

Fix: Align your commercial roadmap with regulatory + access strategy (e.g., CE mark + DiGA listing or NICE submission).

Resource: See MDR timeline & guidance from the European Commission.

5. Over-Investing in the Wrong Channel Early

Mistake: Hiring a large sales team before validating CAC or message fit.

Burning capital on outbound reps without understanding the sales motion leads to churn and stalled traction.

Fix: Run test campaigns with fractional reps, digital outreach, or advisor-led selling before hiring full-time field force.

Summary Table: Mistakes & Fixes

| Mistake | Fix |

| No buyer validation | Conduct payer & JTBD interviews |

| Pilot fatigue | Design conversion-ready pilots |

| Procurement blockers | Involve early, prep documentation |

| CE mark ≠ market fit | Layer regulatory + access planning |

| Premature sales hires | Validate channels first |

Final Word

Commercialization in MedTech is not just execution — it’s sequencing. Avoiding these five traps increases the odds of landing not just pilots or press — but scalable, reimbursed adoption.

Explore more: – Why Pear Therapeutics failed despite FDA clearance – How Bigfoot Biomedical sequenced product + payer strategy

This wraps our series on Scaling MedTech — let us know what topic you want next.

This content has been enhanced with GenAI tools.