Workflow AI meets hard regs: funding into clinical workforce & pathology AI, a CEE mental health roll-up, and CE marks in resuscitation, MSK and neuro-mobility.

People on the move

Haughton Design (UK) appoints Dr. Ash Ghadar as CEO to scale medtech/drug-delivery design services; a reminder that device commercialisation chops are in demand.

Allianz Partners (FR) names Okan Özdemir Chief Officer for Health & Board Member; payer-side signal for digital health distribution.

Money flows

Teton.ai (DK) $20M Series A, predictive eldercare AI; Plural leads with Bertelsmann Investments, Antler Elevate, Nebular and PSV Tech. Funds to push EU/US rollout and dataset expansion.

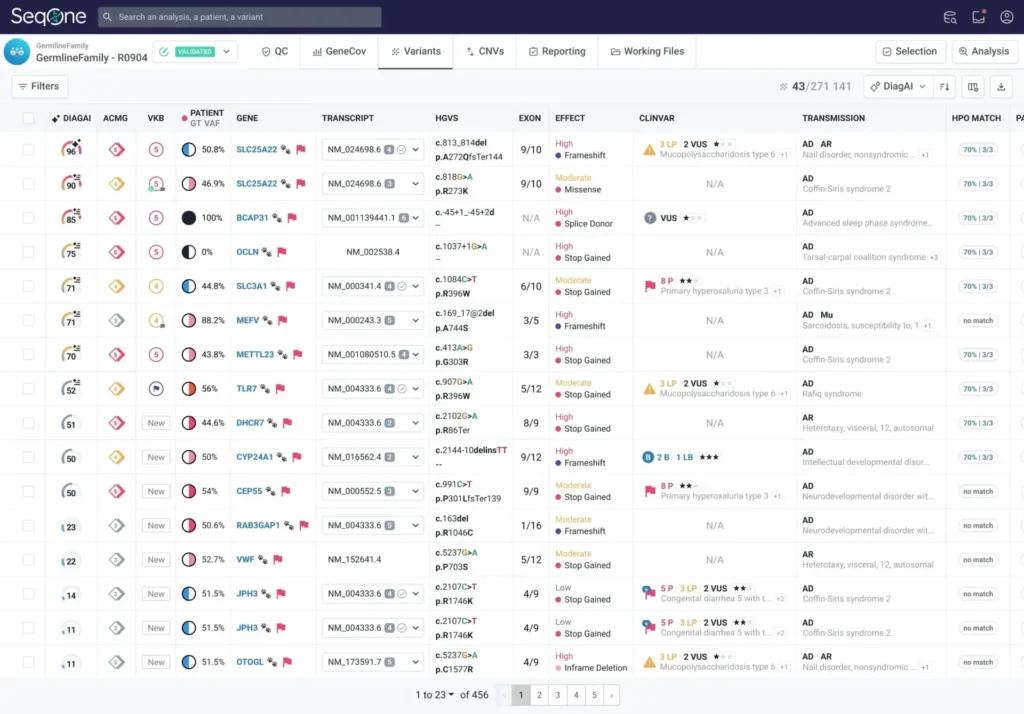

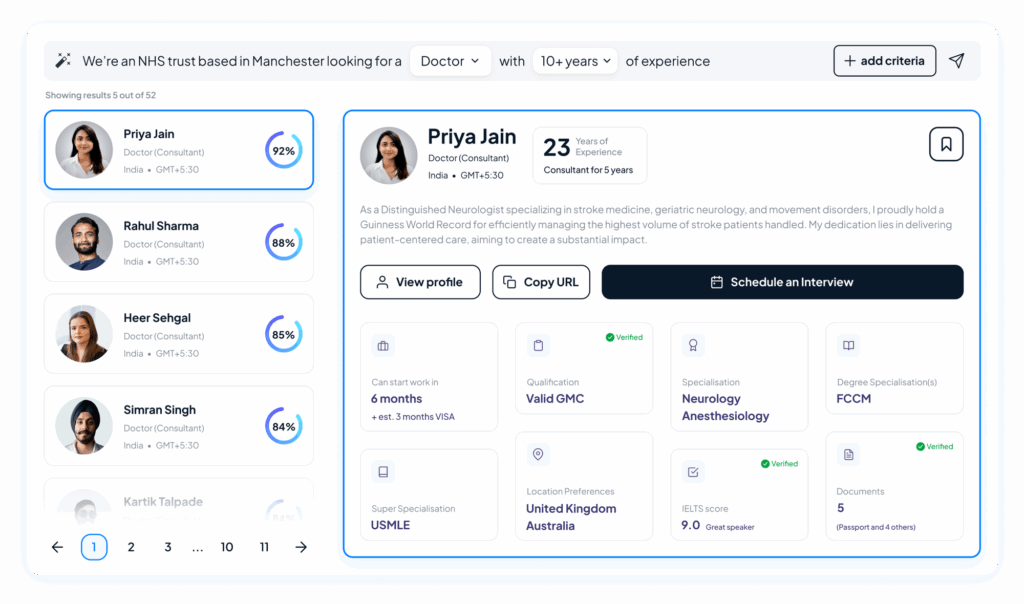

TERN Group (UK) €20M Series A; AI clinical workforce platform to optimise staffing across Europe & GCC; led by Notion Capital with RTP Global, LocalGlobe, EQ2, Leo Capital et al.

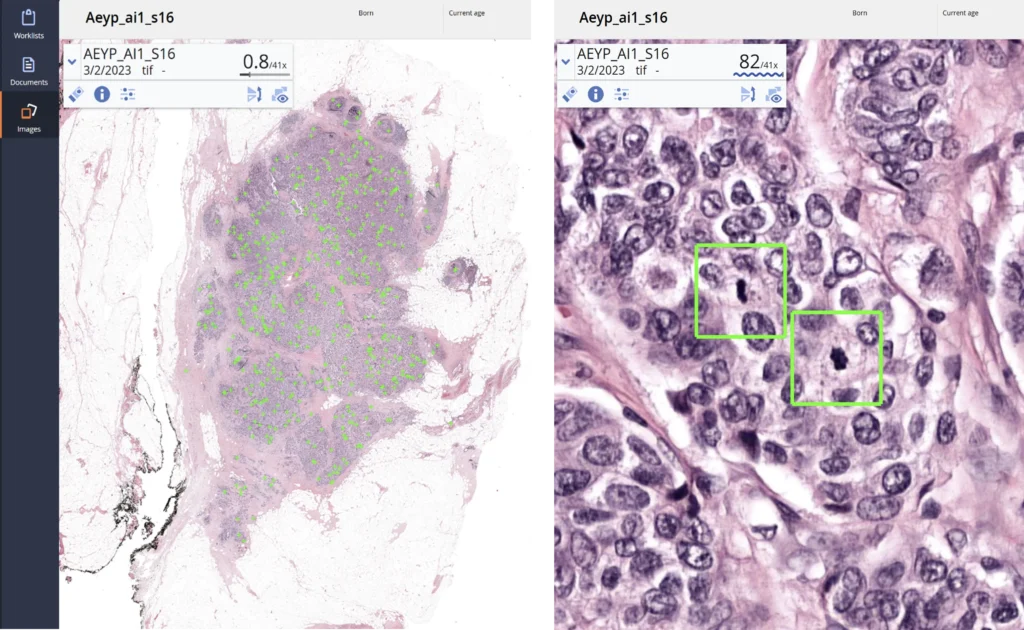

Aiosyn (NL) €2.4M to advance AI pathology tools for cancer diagnostics; supports validation and productisation with Dutch partners.

SafeHeal (FR) €10M Series C extension led by Asabys to accelerate EU commercial launch of Colovac and continue U.S. study.

Hedepy (CZ) acquires Poland’s HearMe (terms undisclosed) to consolidate CEE online psychotherapy; adds 80+ corporate clients and 120+ professionals; founders join leadership

On the press

• Neurescue (DK) wins CE mark under MDR for its intelligent aortic balloon catheter; the first device approved to treat non-shockable cardiac arrest in Europe.

• Varian (Siemens Healthineers) secures CE mark for Embozene microspheres in genicular artery embolisation (GAE) for knee osteoarthritis; first CE-marked embolic for GAE.

• Lifeward (IL/US) gains CE mark for ReWalk 7 personal exoskeleton; EU commercial launch enabled, with Germany a key reimbursed market.

• Report: Europe’s 10 biggest healthtech deals in H1 2025: €4B raised; UK led by volume. Useful late-stage context.

One thing to remember

Regulatory traction is back: three CE marks in one week (resuscitation, MSK pain, neuro-mobility) while capital flowed to workflow AI (staffing, lab data) and pathology. EU buyers will reward products that unblock staffing, data, and function bottlenecks.

This content has been enhanced with GenAI.