European healthcare shifts from “growth at all costs” toward commercial execution as precision pathology, ocular structural integrity, and public-market readiness dominate the landscape.

People on the move

Amadeus Capital Partners / Pierre Socha — The veteran HealthTech investor has been appointed to the Royal Society’s Science, Industry and Translation Committee. Socha will advise on financing and commercialization models for DeepTech and HealthTech companies as the UK enters a new deep-tech “super-cycle.” (<a href=”https://www.businessweekly.co.uk/posts/amadeus-partner-pierre-socha-appointed-to-royal-societys-science-industry-and-translation” title=”Business Weekly”>Business Weekly</a> (Feb 9, 2026))

Amadeus Capital Partners / Pierre Socha

The veteran HealthTech investor has been appointed to the Royal Society’s Science, Industry and Translation Committee. Socha will advise on financing and commercialization models for DeepTech and HealthTech companies as the UK enters a new deep-tech “super-cycle.”

Integrum (Sweden) /

Per Nilsson

The bone-anchored prosthetics leader has appointed Per Nilsson as Chief Supply Chain Officer (effective March 16). The move is part of a broader leadership reshuffle to accelerate the commercialization of the OPRA® system by sharpening patient journey and supply chain execution.

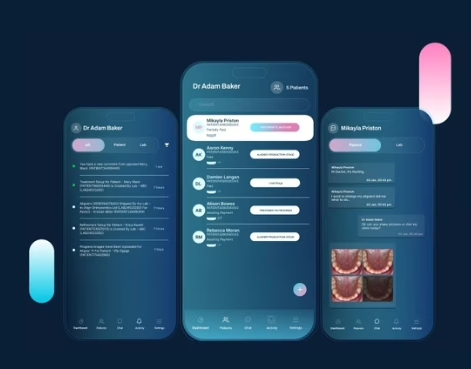

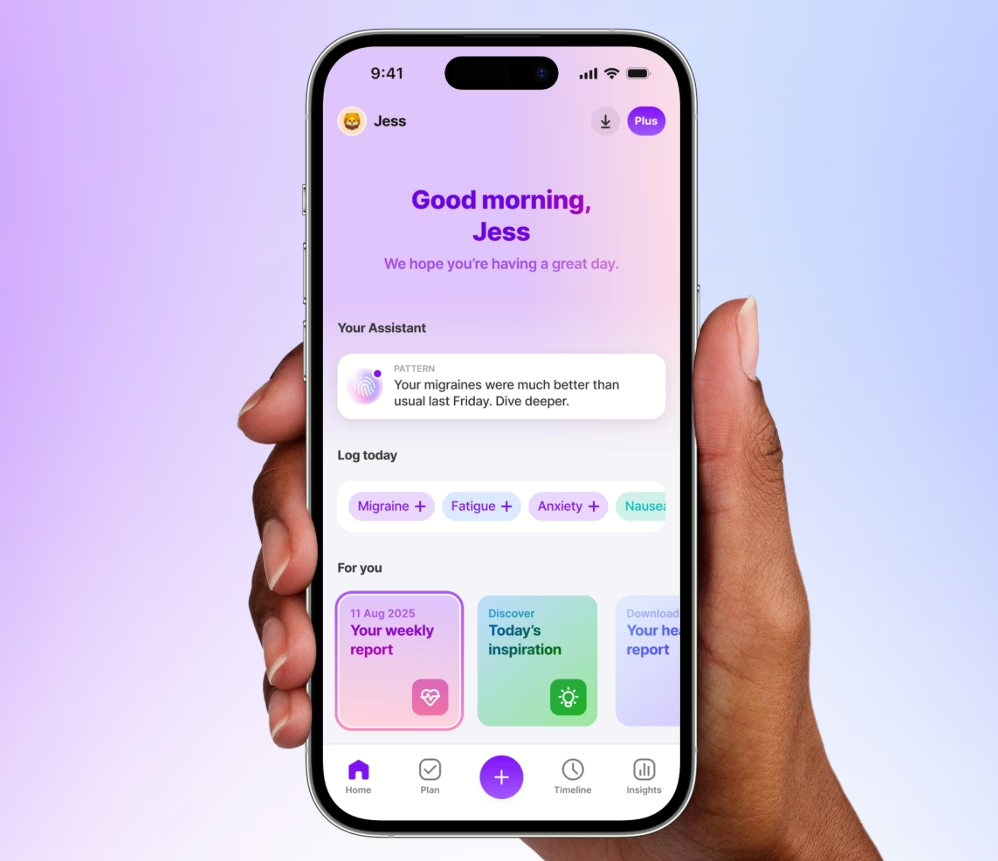

Ahead Health (Switzerland) / Nick Lenten

Following a $6M seed round reported this week, the Zurich-based personal health “operating system” led by Nick Lenten (ex-Google) is aggressively expanding its AI-native platform across DACH partner clinics.

Money flows

Agomab Therapeutics (Belgium) $200 million, NASDAQ IPO, Immunology/Biotech; The Belgian firm’s successful US listing signals a significant reopening of the public market window for European life science and medtech-adjacent scaleups.

On the press

- Eye PCR (Netherlands)

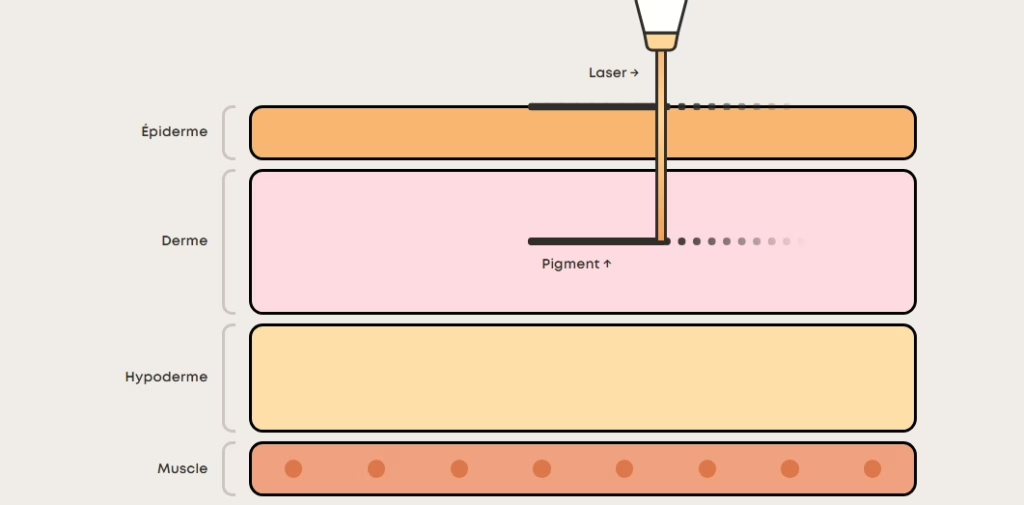

The Amsterdam-headquartered firm received CE Mark certification under EU MDR 2017/745 for its fixOflex endocapsular device, a breakthrough for preserving ocular structural integrity during cataract surgery. - SEISMIC Consortium / Philips

Secured €23.5 million in Innovative Health Initiative (IHI) public funding. This five-year program integrates imaging with minimally invasive techniques for next-generation brain treatments. - Median Technologies (France)

While securing US FDA 510(k) clearance for eyonis LCS (lung cancer screening), the French AI firm confirmed CE marking for the European market is on track for Q2 2026. - Horizon Europe — Official 2026 “Health” calls are published with deadlines in April. Priority areas include cardiovascular health scaling and regulatory science for patient-centered technologies.

One thing to remember

Investors are currently backing regulated, workflow-embedded platforms (pharma-grade companions and preventive clinics) over point solutions. The signal for 2026 is clear: capital is flowing toward teams that can turn research infrastructure into deployable, CE-marked clinical proof.